Core banking transformation

Migrating to cloud-native banking made less painful.

With 10x, transforming your core is much less painful. Improve your bank's agility by migrating to SuperCore® – our cloud-native core banking platform.

Delivered as a SaaS managed service that runs your core in the cloud, our technologists and experienced banking specialists support the full lifecycle of your transformation – from proof of concept to migration and beyond.

Become a next-generation bank powered by real-time data that your customers love.

Our cloud banking platform enables banks to operate at up to 70% cheaper than it costs today and, with access to real-time data, banks can tailor their propositions to improve the customer experience.

Remove the risk from core banking transformation

Lower TCO, more customer TLC

Turn core banking into a utility

- Core banking is complex, but many elements don't differentiate your bank. We manage these for you, so you can focus on customer innovation.

- Reduce total cost of ownership by up to 70%1 – rethink your operating model and

1Source: Bain and Co, The Digital Attackers’ Time Has Come

Architected to flex

- Accelerate your time to market with pre-integrated technologies across payments, card issuing/ processing, fraud, and customer servicing.

- Our API-first and events-based architecture makes integrating front and backend systems easier and gives you ultimate control over the customer experience.

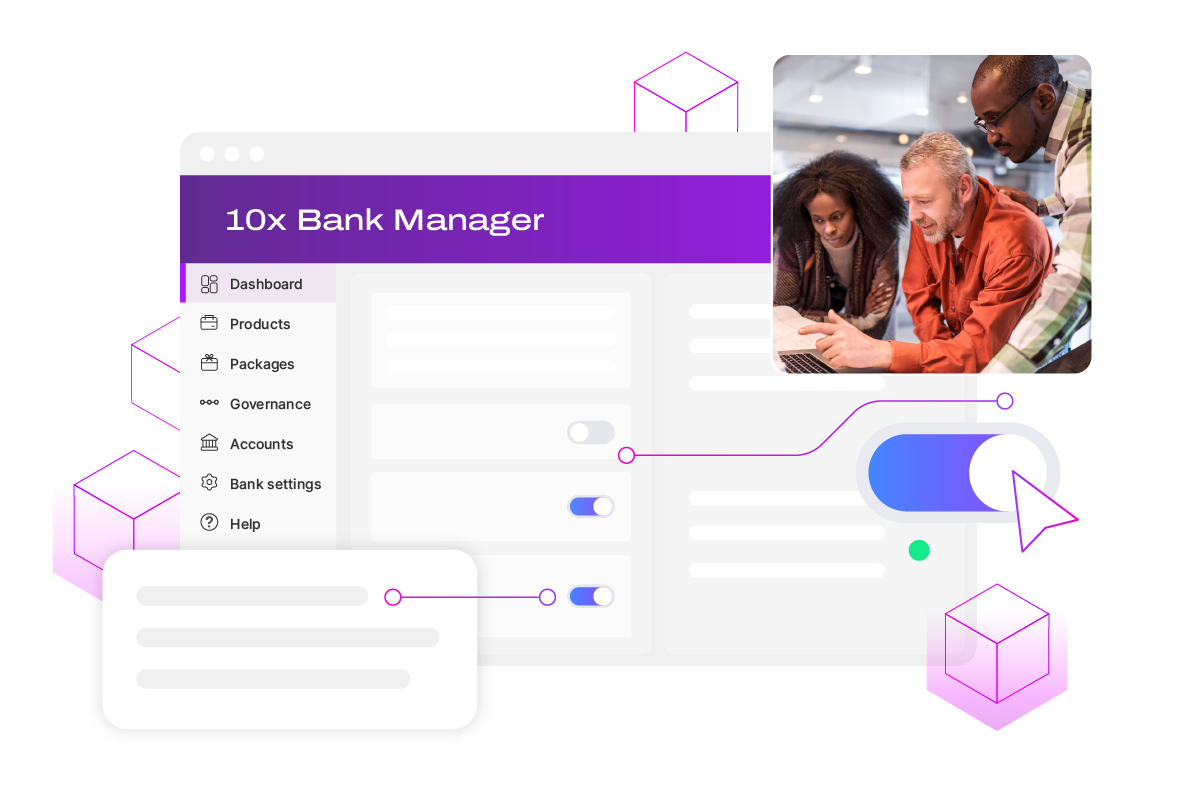

- Launch products faster with Bank Manager, our no-code product builder, which lets you design dynamic propositions in minutes.

Get closer to data,

get closer to customers

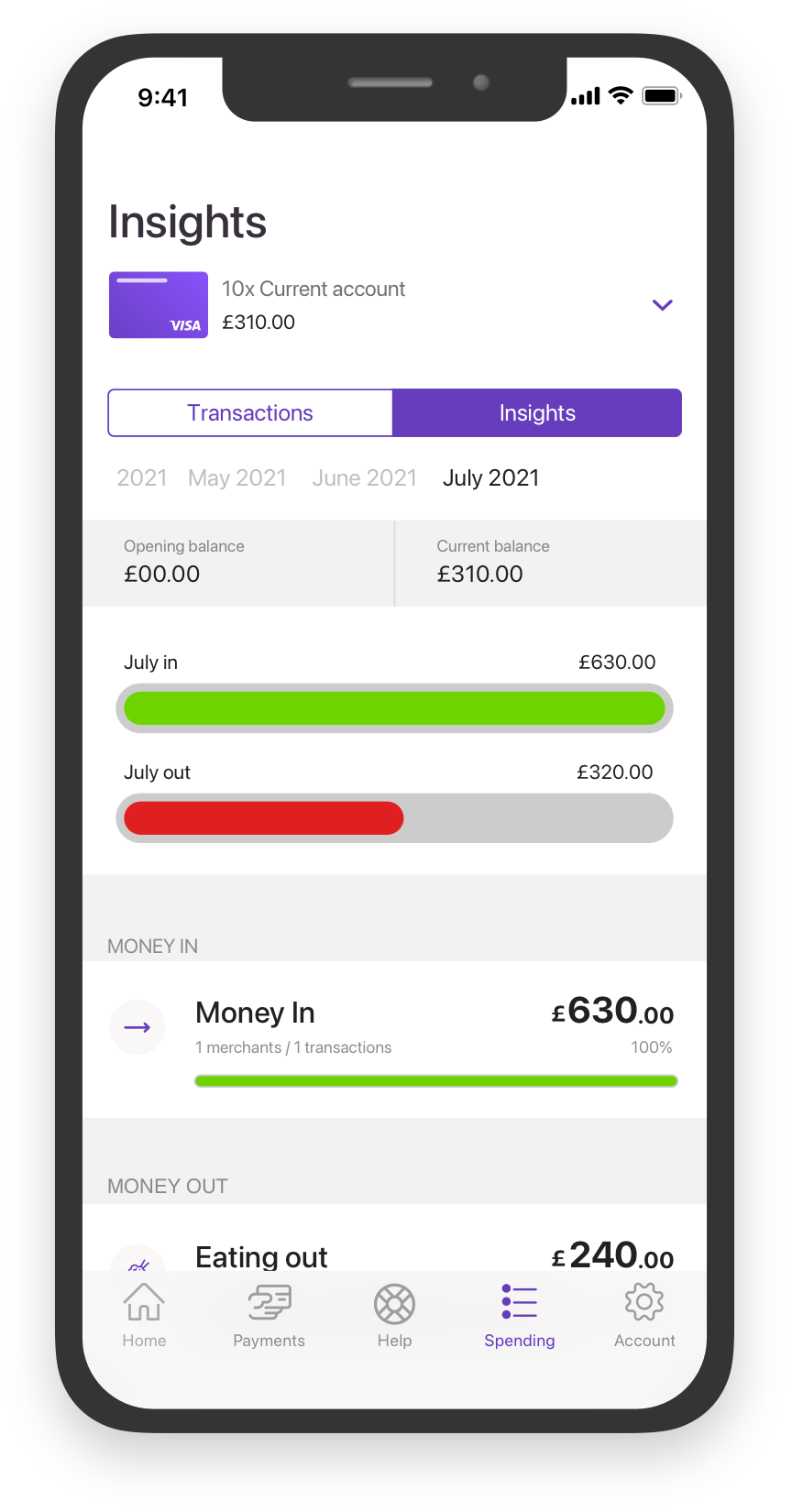

- Move from batch to real time.

- Remove data siloes with a unified data model.

- Test and launch hyper-personalized experiences faster than the competition.

- Get a single view of every customer, across their entire banking relationship, for better customer service and cross-selling opportunities.

Supporting your unique migration journey

- Migrate the way that suits your customer groups and product lines, moving in as many stages as you need.

- With a transparent shared responsibility model, we work with your teams and systems integrators to ensure a smooth data handover for upload.

- Once your migration path is mapped out, our reconciliation processes and real-time dashboard give you the comfort that customers have continuous service throughout the migration.

- After your migration, our managed service and evergreen platform keep your core up to date.

Lead the market, in any market

12 minutes to create a product

Configure, test, and launch new products with just a few clicks.

12 weeks to launch a bank

Remove complexity from your tech stack to focus on value-add activities and swift deployment.

Millions of customers in less than 12 months

Powered by 10x SuperCore, Chase UK moved from launch to one million customers in months.

Mapping your migration

Product strategy

Front-book migration

Data clean-up

Extract and transform

Back-book migration

Post-live monitoring

A proven platform powering the world's biggest banks

Transformative

Predictable

Proactive

Agile

Trusted

Marketing and Communications

Lorem ipsum dolor sit amet, consectetur