Drive real banking transformation with the 10x Banking Platform

Built on the cloud-native core banking platform that powers Britain's Best Bank; we understand that real banking transformation requires more than modern technology - it requires the right foundations, deep banking understanding, and the freedom to evolve without compromise.

Core banking trends 2026

For our 2026 Trends report, we gathered insights from senior leaders at 10x Banking and partners across the industry to reveal what’s next. The signal is clear: after years of incrementalism, banking is entering a phase of accelerated, structural change.

Download the report

High-value

personalization

All products, all verticals; your coding language

Transformation

without compromise

Architected to leave behind legacy and neo core limitations - modular by default, extensible by design.

Commit

with confidence

Trust in market-leading security, scalability and robust resilience

High-value development tooling

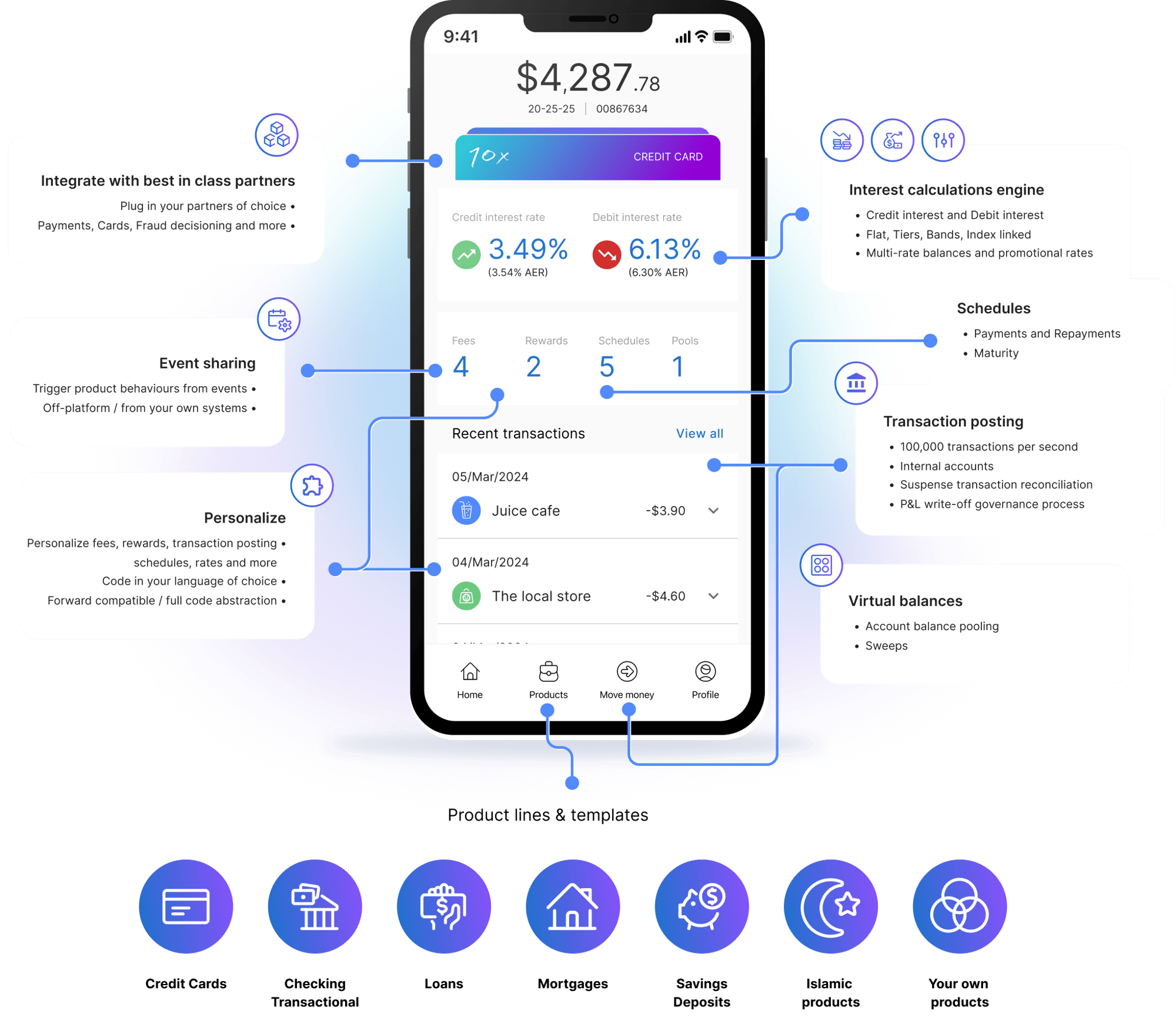

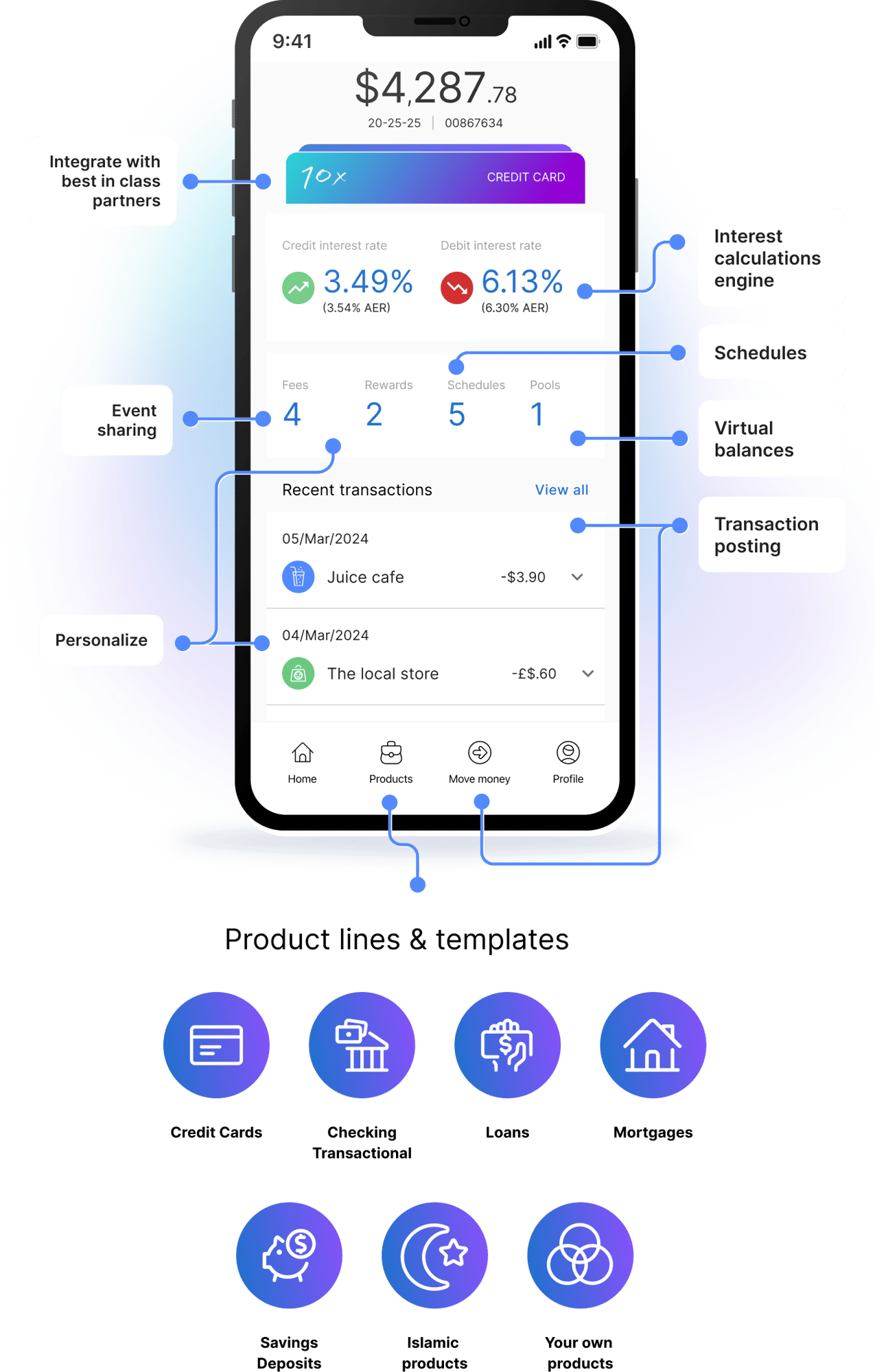

Build fast with 10x ProductKit

Use 10x's ProductKit's SDK and API's to build and maintain full-featured financial Virtual Products. Create, update and iterate with speed and precision, free from change requests and re-building commodity code.

Personalization that’s forward compatible

Interoperable by design, the platform is ready for all developer programming languages from .Net to Java to Python and API-ready for your ecosystem.

Founded on best-in-class core banking technology

Enabling real banking transformation with a cloud‑native core banking platform that has banking in its DNA - modular by default, extensible by design. We've solved for the challenges of legacy and neo core technology to bring you a de-risked path to transformation.

The 10x Banking Platform comes with the world's most powerful managed core and a rich layer of pre-built product fundamentals. Allowing your teams to focus on your high-value personalization and localization.

Supercharged banking fundamentals

We've taken SaaS to the next level.

The 10x Banking Platform comes with the world's most powerful managed core and a layer of pre-built product fundamentals.

Allowing your teams to focus on your high-value differentiators.

Resilience

World-leading sec ops

Availability and support

See the 10x Platform in action

The key features of the platform and how they solve your challenges

Examples of quick and easy product creation and customization

Other client success stories

Fill in the form to get set up some time with our team. Build your bank's future faster with the 10x Banking Platform.