Embedded Finance

Enabling partnerships between banks and

non-financial brands

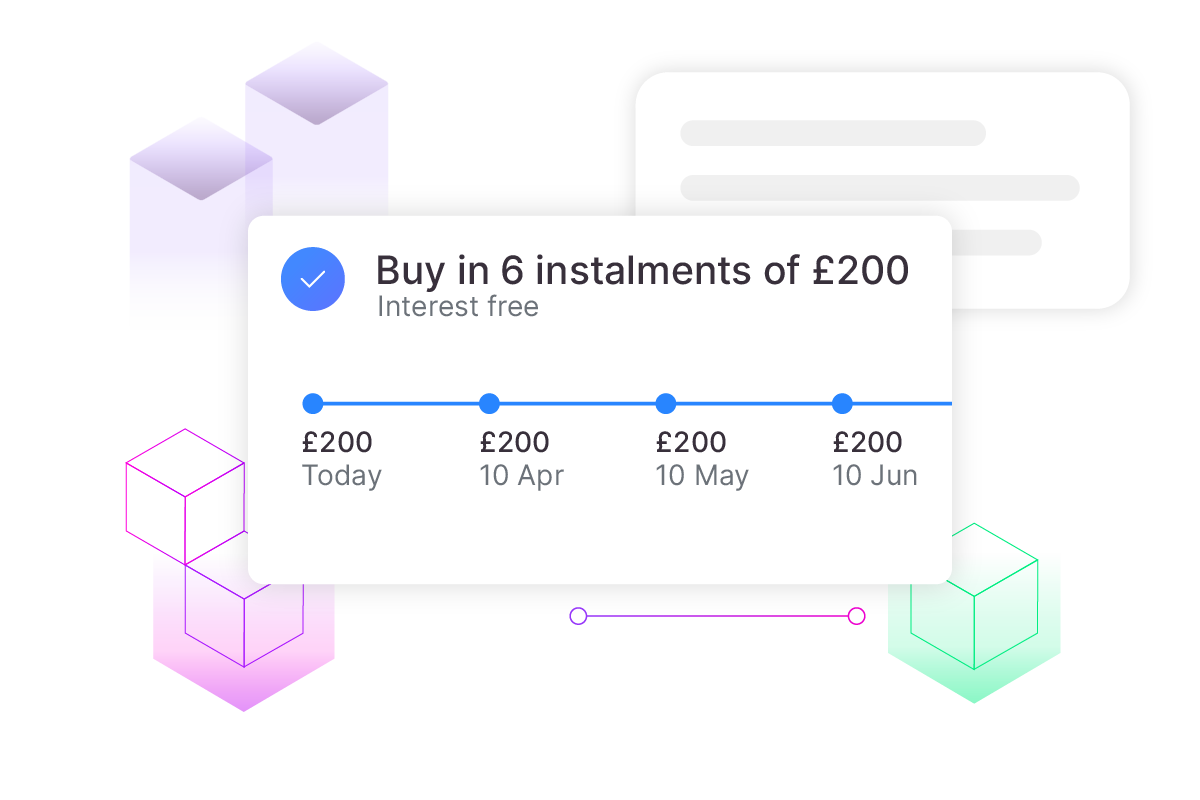

Embedded finance helps banks reach new audiences, and non-financial brands bring value-added services to their customer journeys.

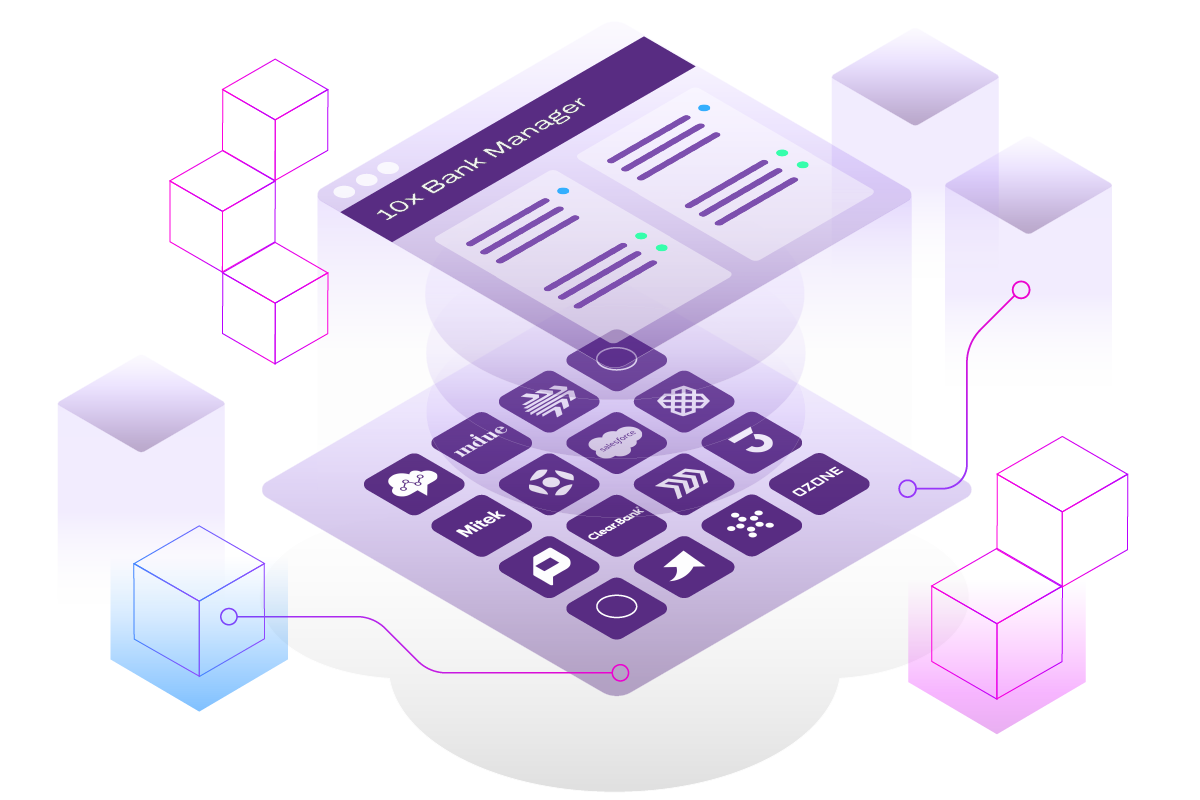

SuperCore®, our next-generation core banking platform, powers the financial backend of these experiences, enabling banks and brands to partner, integrate, and get to market quickly.

Enterprise-grade and proven in the real world, SuperCore® gives:

-

Banks a next-generation Banking as a Service (BaaS) platform to reach new customers at a low cost.

-

Brands a way to embed new revenue streams into apps to boost customer lifetime value.

Westpac’s partnership with 10x has allowed us to offer products to customers through a transformative business model. We are reaching new customers when and how they want it, and in the palm of their hand.

De-risk the journey to next-generation banking

What is

Banking as a Service?

Hear from Peter Timmins, Regional Director for APAC at 10x,

as he discusses how to make BaaS work for banks, customers, and brands, or learn how to make embedded finance work for your bank here.

Create seamless banking experiences that enrich the lives of customers

A modern, real-time core enabling easy differentiation

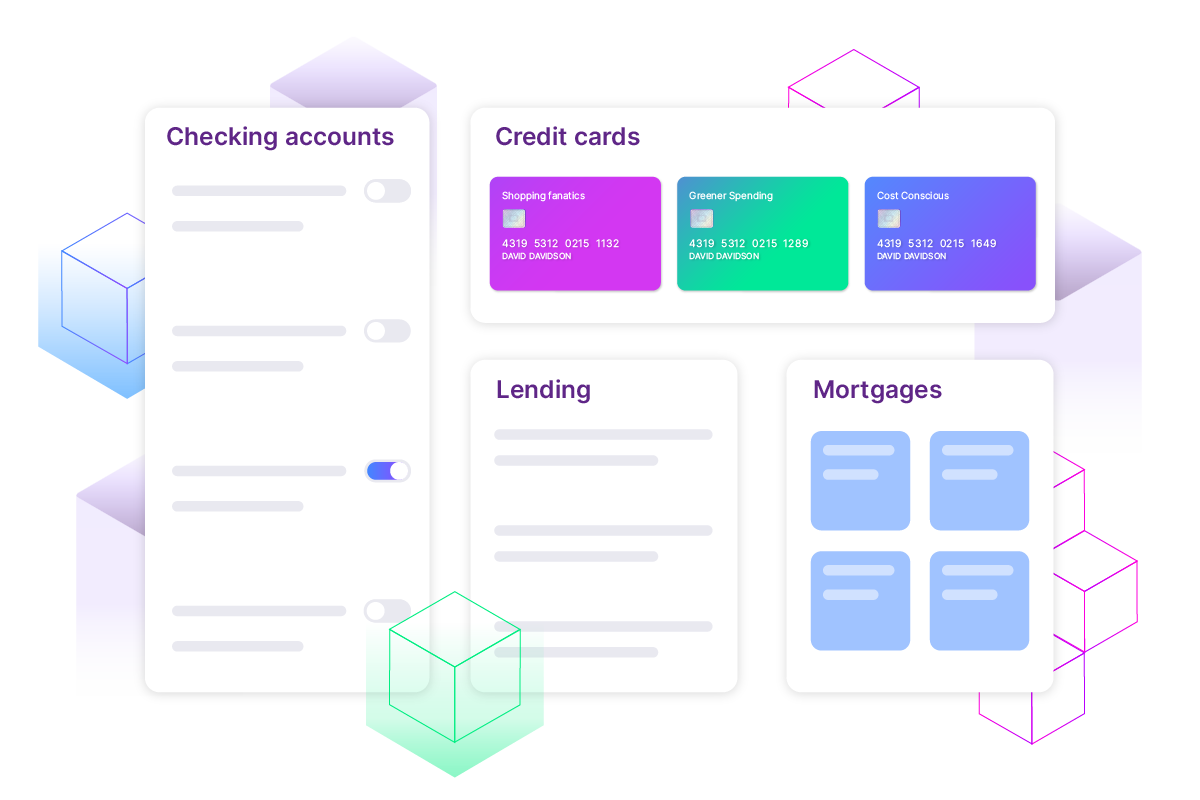

- Our no-code product builder, Bank Manager, means banking products can be built, launched, and updated quickly in clicks.

- Our API-first architecture makes integrating front and backend systems easier, and gives you ultimate control over the customer experience.

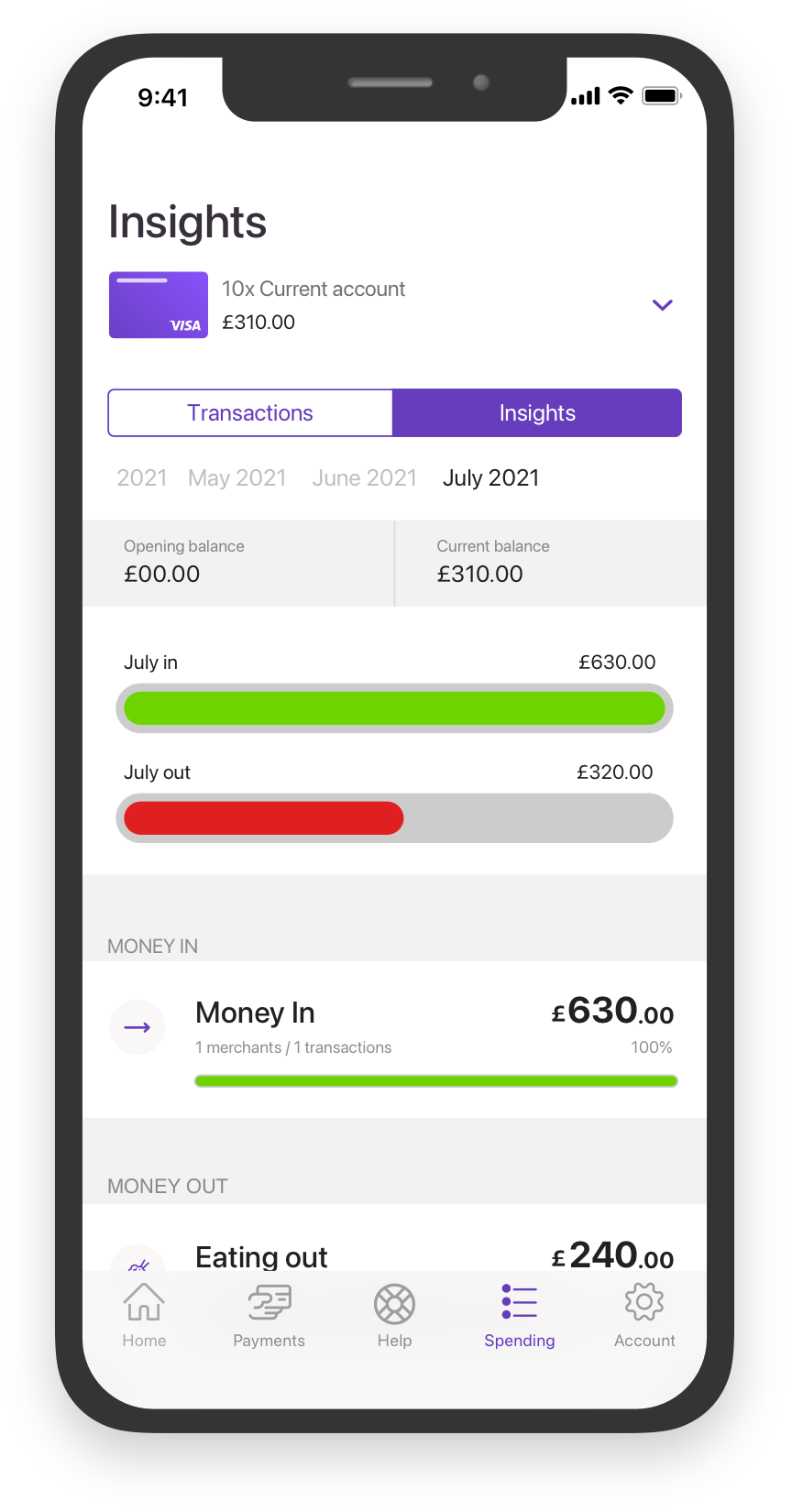

Customer-centric data model

- Our real-time data model and Kafka events stream give you a deep understanding of every customer.

- Get a single view of every customer, across their entire banking relationship, for better customer service, marketing, and cross-selling opportunities.

- Multi-tenancy enables banks to run one platform with multiple brands.

Supported by people and technology you can trust

- Core banking is complex. But many elements don’t differentiate your BaaS proposition. We manage these for you, so you can focus on evolving your proposition.

- Our managed service ensures your core banking platform is always on, with 24x7 security operations, migration support, and much more.

- Our in-house teams are set up to interface with yours, enabling you to run an enterprise-grade banking proposition with less tech overheads.

Lead the market, in any market

12 minutes to create a product

Configure, test, and launch new products with just a few clicks.

12 weeks to launch a bank

Remove complexity from your tech stack to focus on value-add activities and swift deployment.

Millions of customers in less than 12 months

Powered by 10x SuperCore, Chase UK moved from launch to one million customers in months.

Your journey to live with 10x

Proof of Concept

Joint discovery

Dedicated client delivery team

Migration

A proven platform powering the world’s biggest banks

Transformative

Predictable

Proactive

Agile

Trusted

Marketing and Communications

Lorem ipsum dolor sit amet, consectetur