Improve customer loyalty

Find new ways to acquire and retain customers

In a world of challengers, specialized fintechs, and slick user experiences, banks must find new ways to acquire and retain customers.

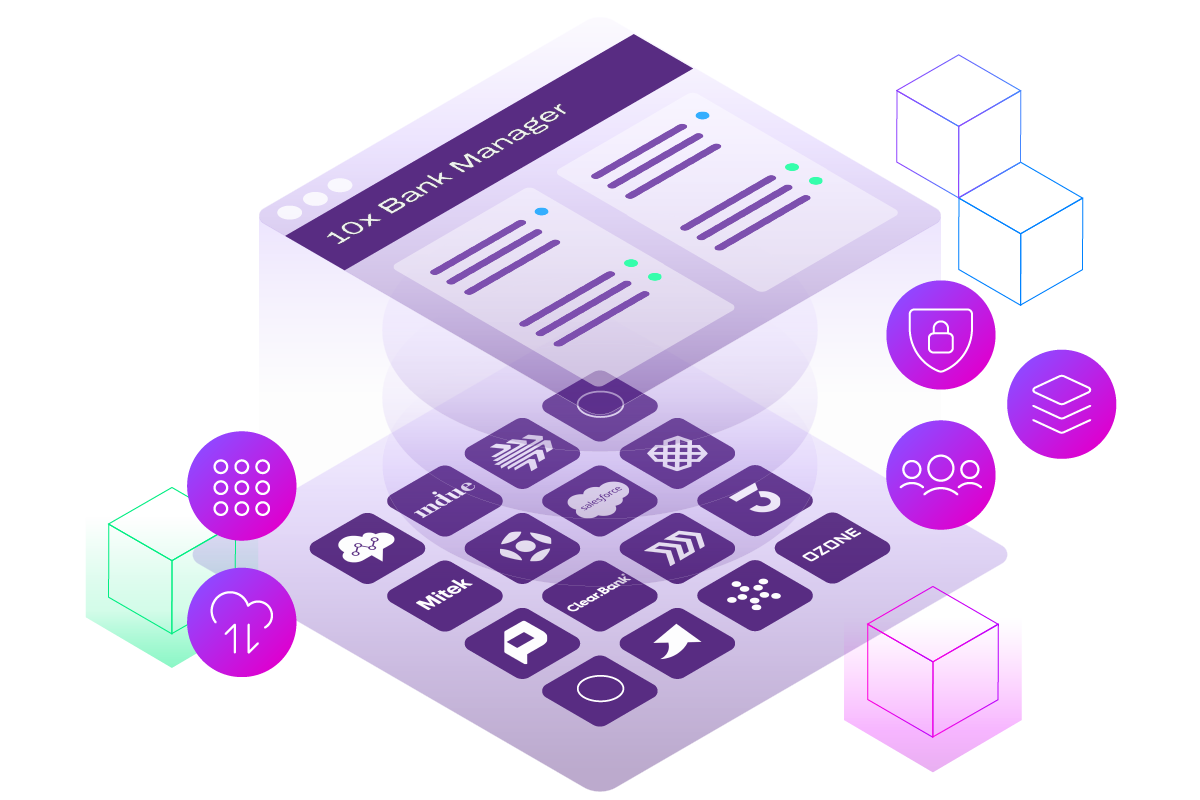

Our next-generation core banking platform, SuperCore®, gives you everything you need to serve customers better and stand out from the crowd.

With 10x, you can unlock your data, speed up your product lifecycle, and launch hyper-personalized experiences that customers love.

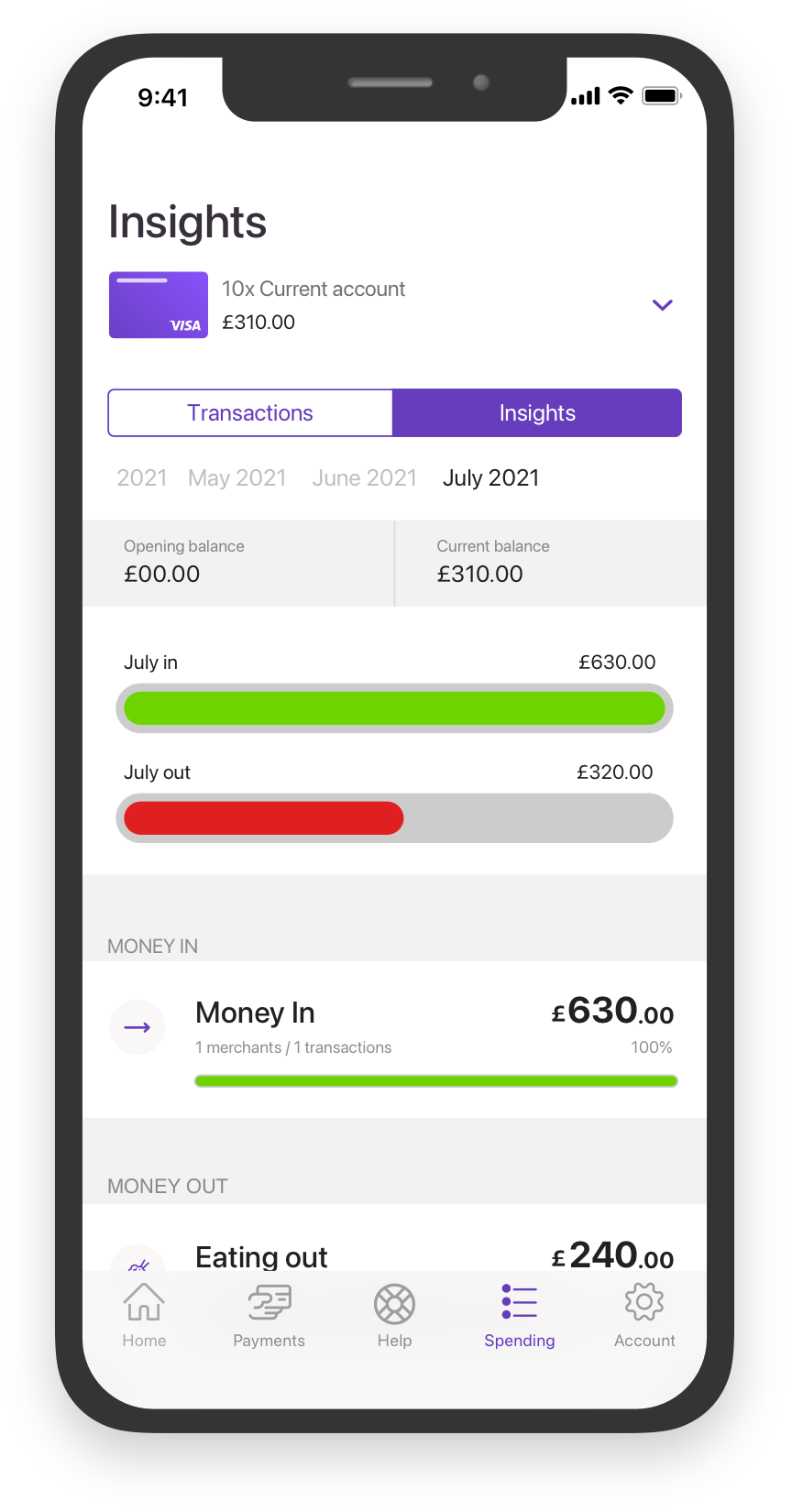

Banks can build a true-to-life picture of who their customers are so rewards and offers can be more tailored to what really matters to them.

How 10x helps you set the pace

Get closer to your data, get closer to your customers

Get data faster and fresher

- Get a real-time view of a customer's entire banking relationship for better servicing and cross-selling.

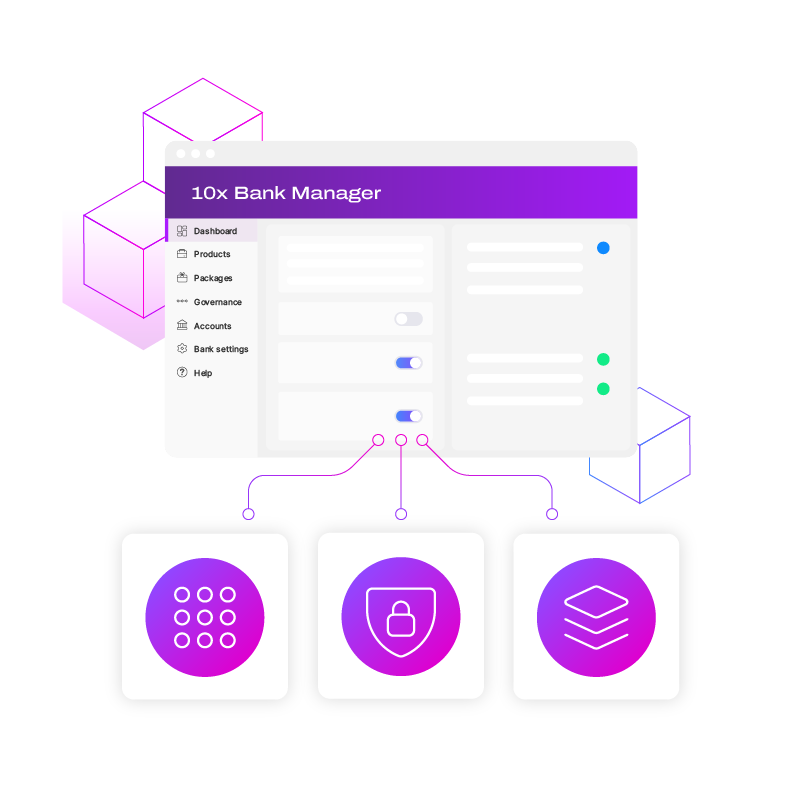

- React to the market quickly with Bank Manager, our no-code product builder, and launch targeted propositions in minutes and days rather than months and years.

- Our real-time data model and Kafka events stream give you a baseline to build experiences unique to each customer based on their behavior.

Joined up customer care out of the box

- Our customer service accelerator, powered by Salesforce, helps customers resolve issues quickly across multiple channels, including asynchronous live chat and telephony.

- Get an accurate 360° view of the customer: updated in real time so your staff always have the freshest data available.

- Complete any action on behalf of the customer – from administrative changes to card management, fraud queries, and much more.

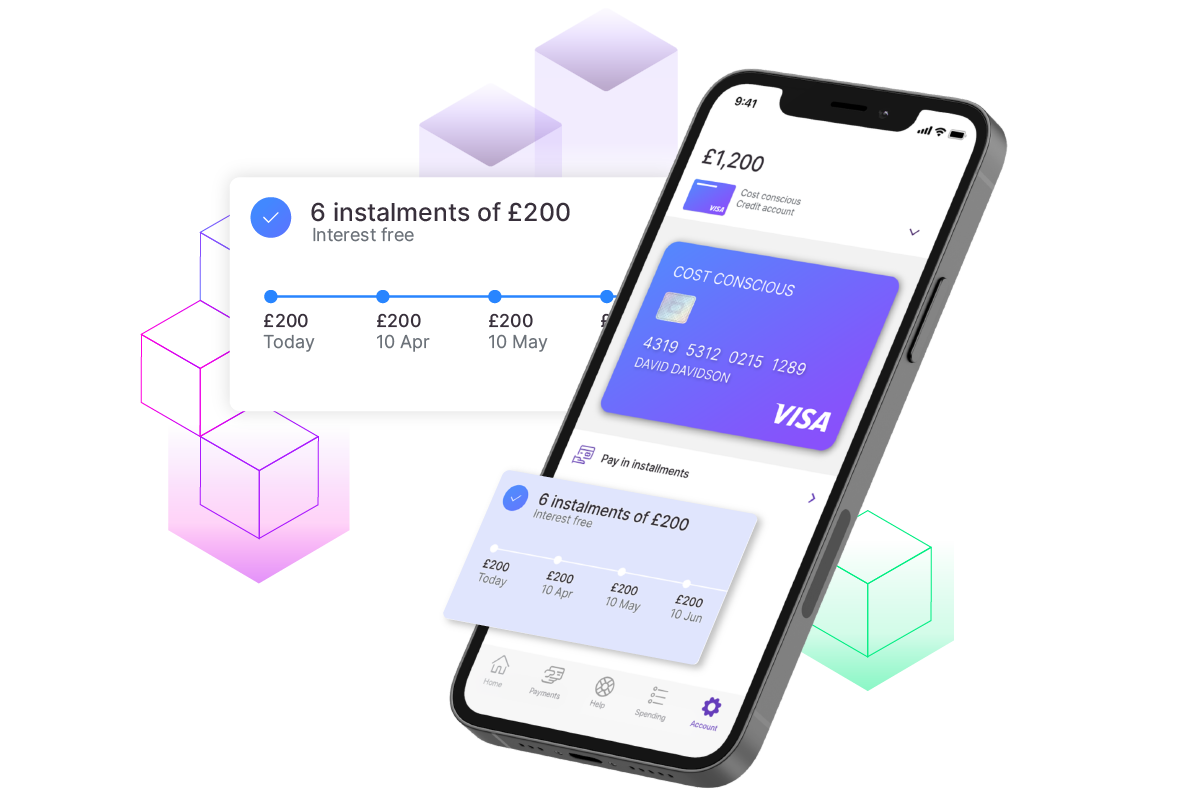

Launch compelling offers, rewards, and experiences

- Integrate with your preferred providers. Build market-leading digital experiences. Create personal finance management tools. Our API-first architecture makes it all much easier.

- Reward customers with cashback, boost their savings with automated round-ups, offer merchant-linked rewards, and much more. Build compelling offers that retain customers without writing a line of code.

Supported by people and technology you can trust

- The world's biggest banking institutions – like Chase and Westpac – trust our secure banking ecosystem.

- Create, innovate, and update any banking product in clicks, not code.

- Our in-house teams – like security, compliance, and operations – are setup to mirror yours, ensuring optimal performance and cohesion with our managed service.

Lead the market, in any market

12 minutes to create a product

Configure, test, and launch new products with just a few clicks.

12 weeks to launch a bank

Remove complexity from your tech stack to focus on value-add activities and swift deployment.

Millions of customers in less than 12 months

Powered by 10x SuperCore, Chase UK moved from launch to one million customers in months.

Your journey to live with 10x

Proof of Concept

Joint discovery

Dedicated client delivery team

Migration

A proven platform powering the world's biggest banks

Transformative

Predictable

Proactive

Agile

Trusted

Marketing and Communications

Lorem ipsum dolor sit amet, consectetur