Lending

From buy now pay later to SME loans, mortgages to asset finance, offer your customers a full suite of secured and unsecured lending products with SuperCore®, our cloud-native core banking platform.

Everything you need to transform your lending portfolio, or launch loans for the first time, and support the ambitions of every customer.

Digital lending products that put your customers in control

A proposition for every customer

Build flexible lending products, including:

- Personal, SME, and commercial loans

- Mortgages

- Trade finance

- Credit cards and balance transfers

- And much more.

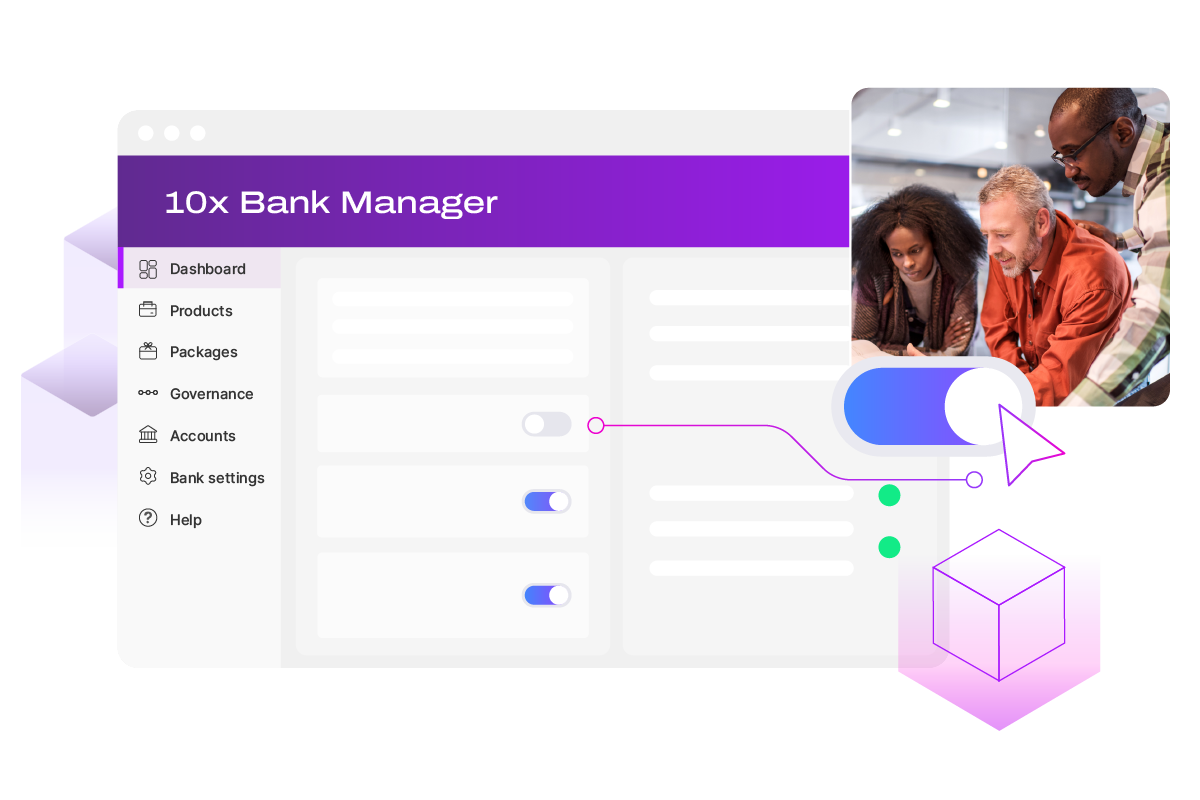

Configure loans with ease and launch same-day updates

Click to build bespoke lending products. Move with the market and make same-day rate changes. Quickly add promotional pricing.

You can build, update, and launch products in less than a day with Bank Manager, our no-code product builder, which lets you click to combine any banking feature.

Using standardized patterns, releasing new products can also be done without complex retesting.

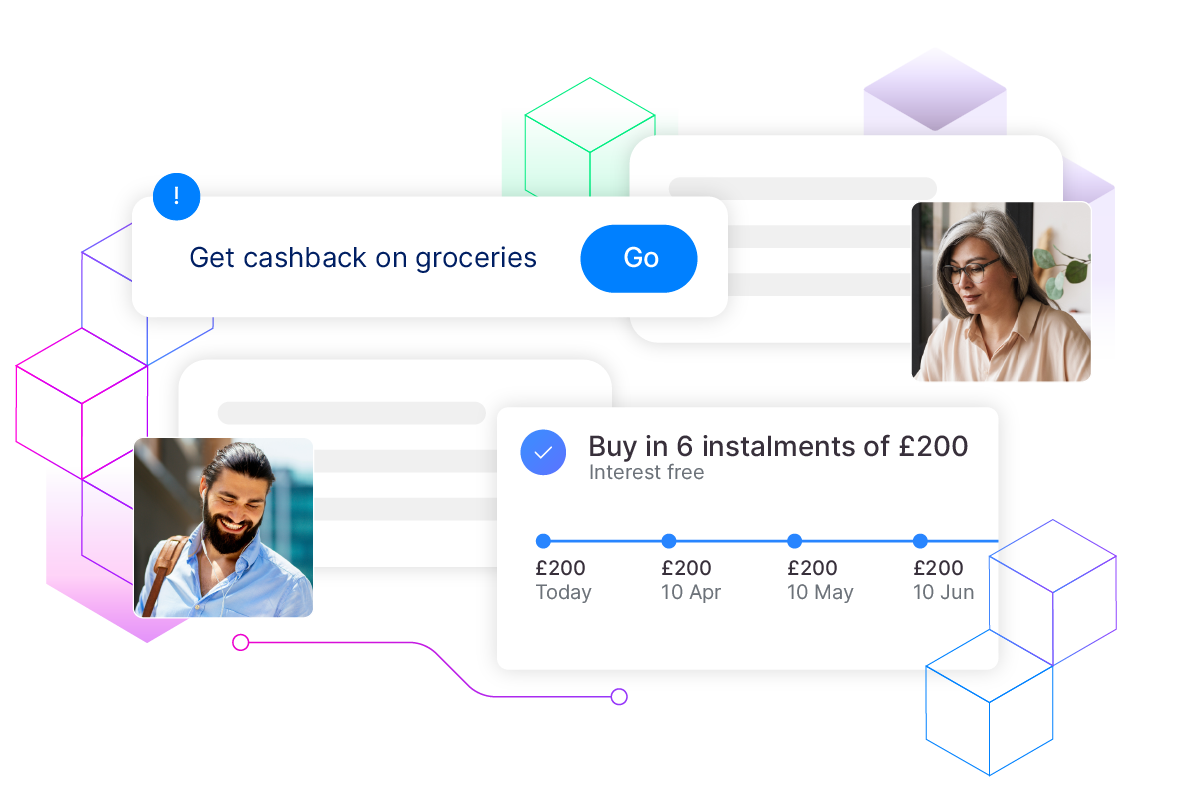

Tailored products, intuitive customer experiences

From personalized risk-based pricing to custom repayment schedules, offer flexible lending products that put your customers in control.

Let them choose the loan term, repayment frequency, credit limit, and more within your bank's chosen parameters.

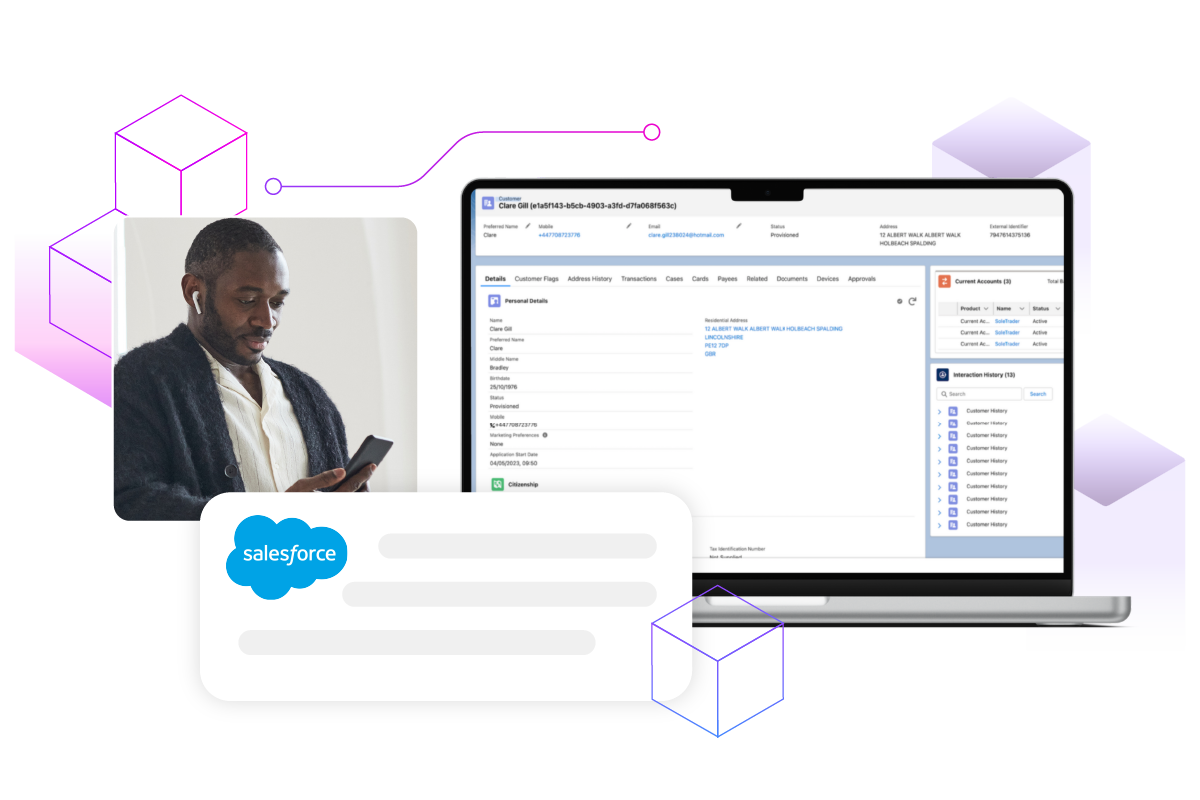

Our customer servicing module, powered by Salesforce, means that when customers get in touch, you can fix their queries faster. It gives you end-to-end customer servicing and a real-time 360° view of every customer.

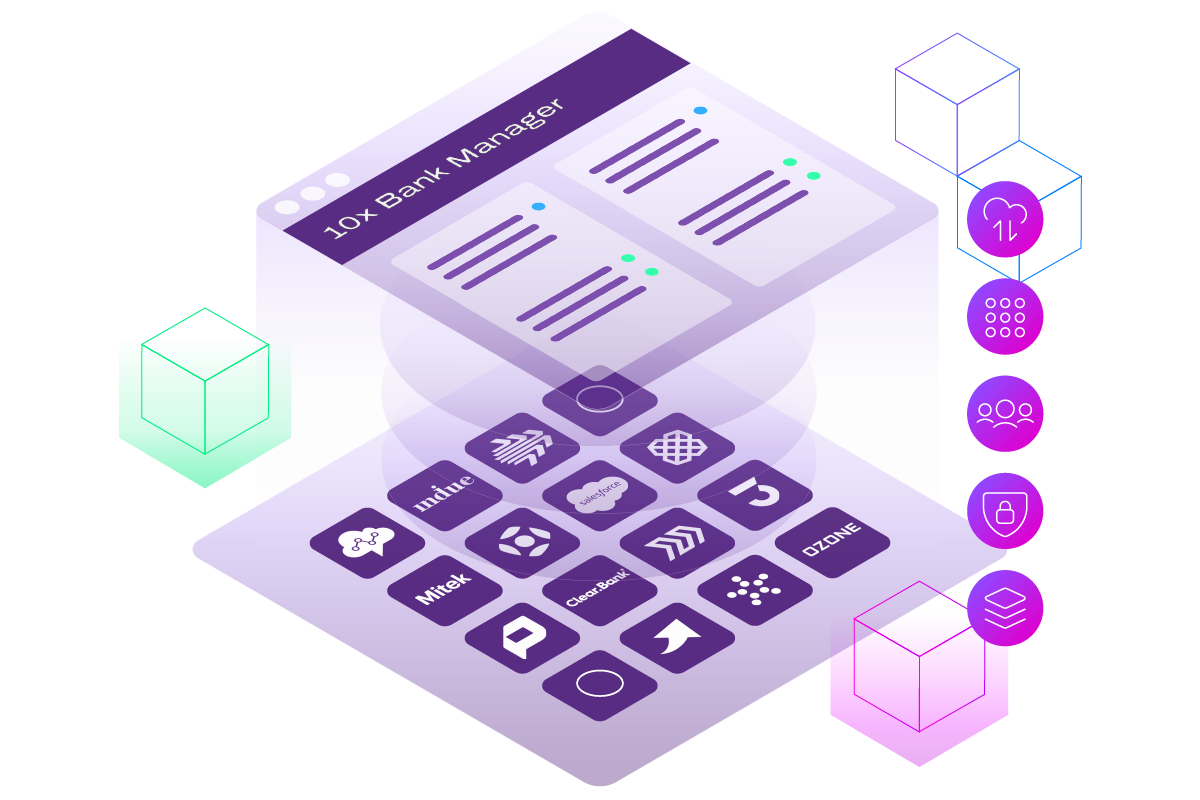

Integrate the world’s best

From origination to front-end apps, our API-first architecture makes it easy to integrate with the technologies of your choice.

With pre-integrations across payments, issuing/ processing, fraud, and customer servicing, you can build a robust banking ecosystem in less time. Learn about our tech partners.

Key features

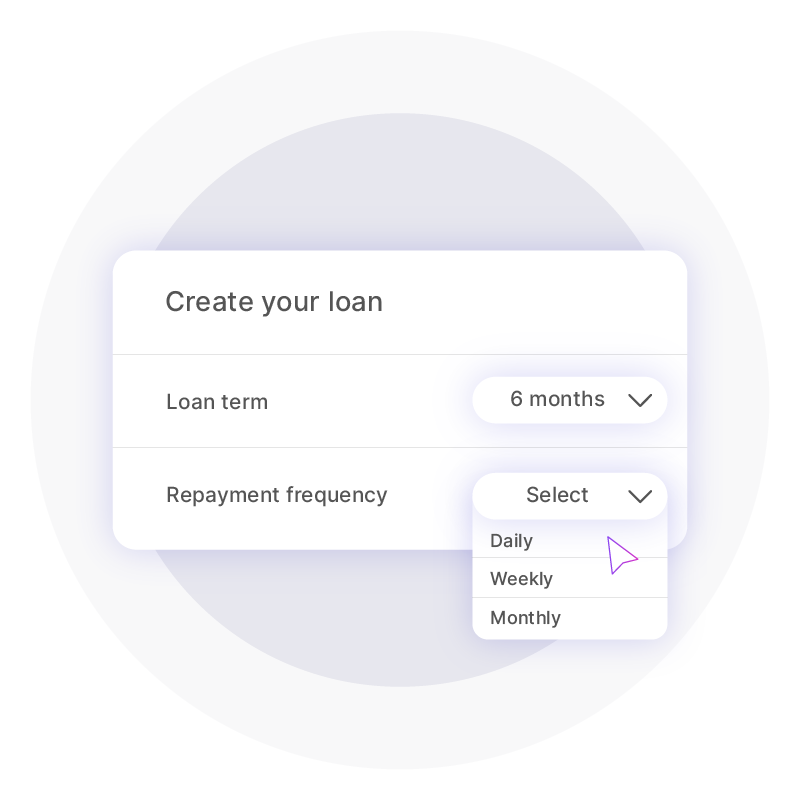

Let customers set the pace

Give customers control and let them set the loan term and repayment frequency (daily, weekly, or monthly) to suit their needs.

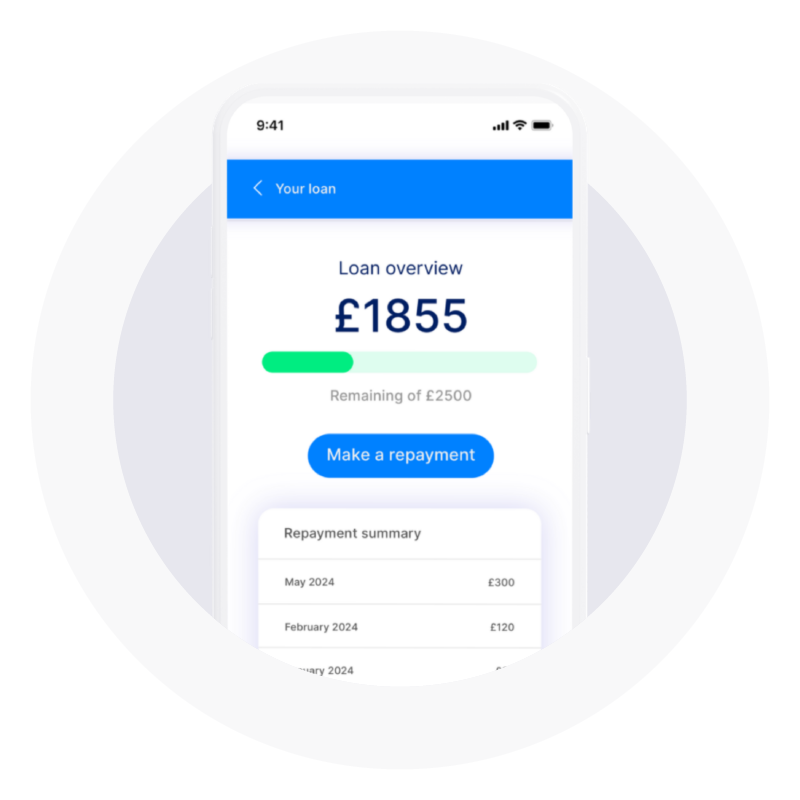

Hyper-personalized repayment plans

Let customers repay any time, any amount – perfect for customers who don’t suit fixed, monthly repayments: like SMEs or customers in financial difficulty.

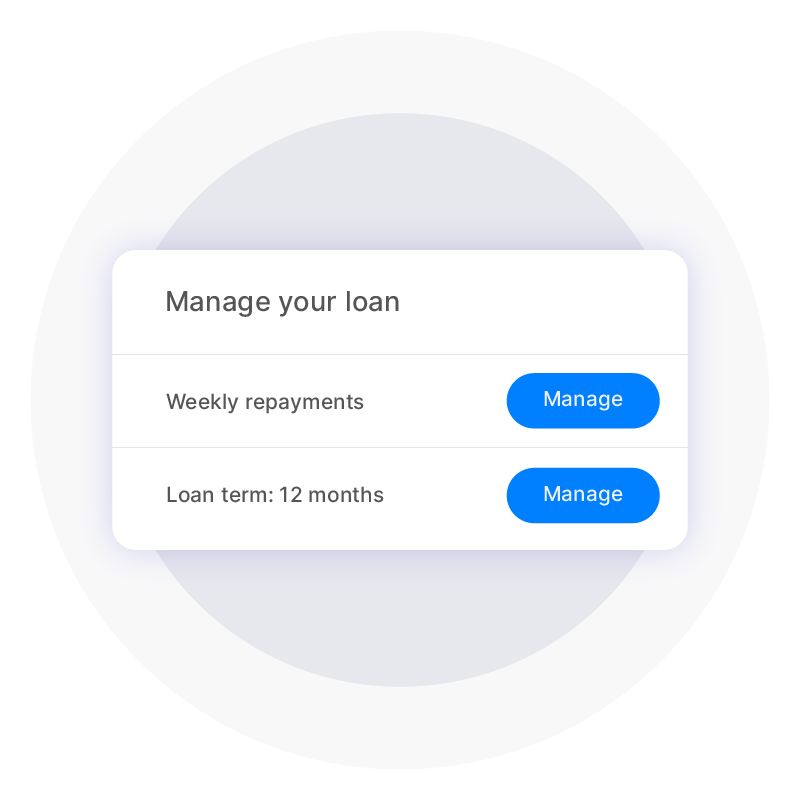

Restructure live loans

Let customers change from monthly to weekly repayments or update their loan term from six to 12 months. Give customers the flexibility to keep on top of their loans as their needs change.