Credit cards

Create next-generation credit card products that keep up with customers, complete with all the flexible in-app features of digital banking.

SuperCore®, our cloud-native banking platform, enables banks to design innovative products, launch physical and virtual cards, and scale to millions of customers.

Everything you need to launch the next big thing. Built to get you there quicker. Already trusted by some of the world’s fastest growing digital banks.

Launch next-generation cards in less time

Lead the market, in any market

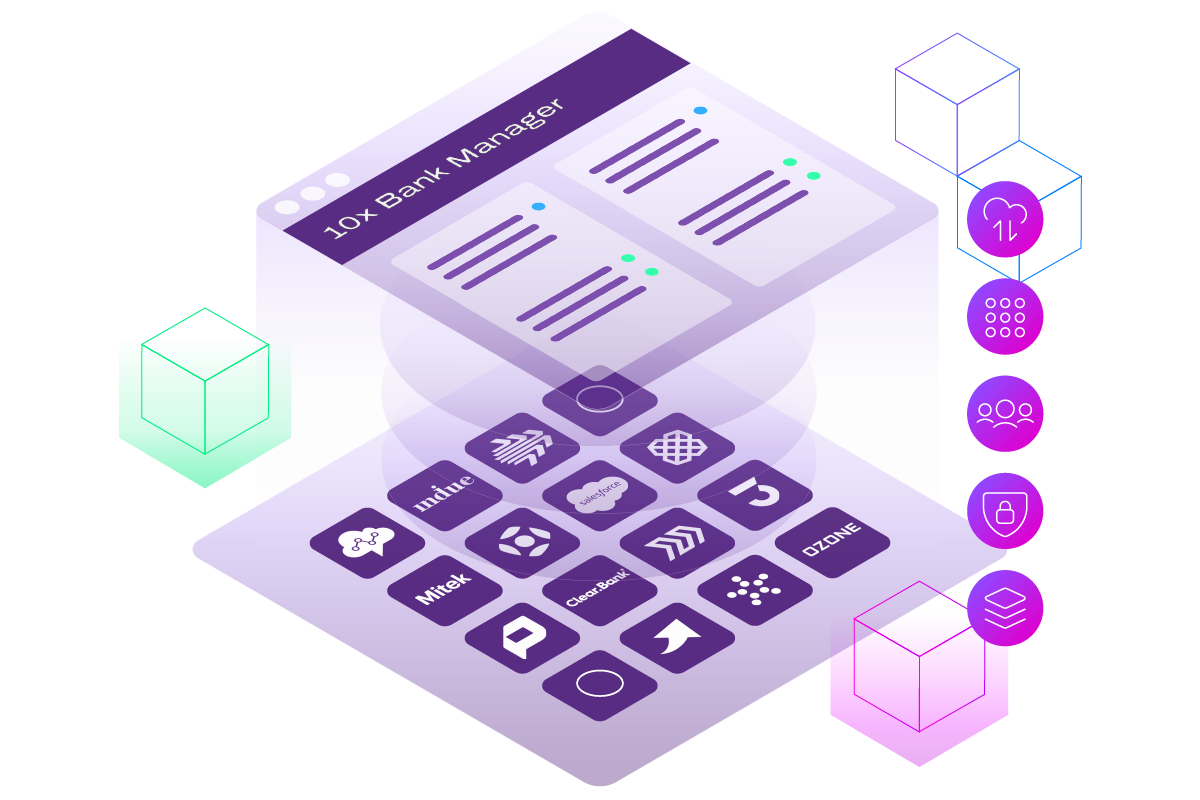

The 10x Cards Accelerator brings you an entire cards ecosystem that you can launch in 12 weeks.

That's a managed service for core banking, plus pre-integrated technologies across payments, card issuing/ processing, customer servicing, fraud, and more.

A card for every use case

As standard SuperCore supports:

- Purchase cards

- Charge cards

- Travel credit cards

- Reward and cashback cards

- Secured or credit builder cards

- Cash advance cards

- Money Transfer cards

- Balance Transfer cards

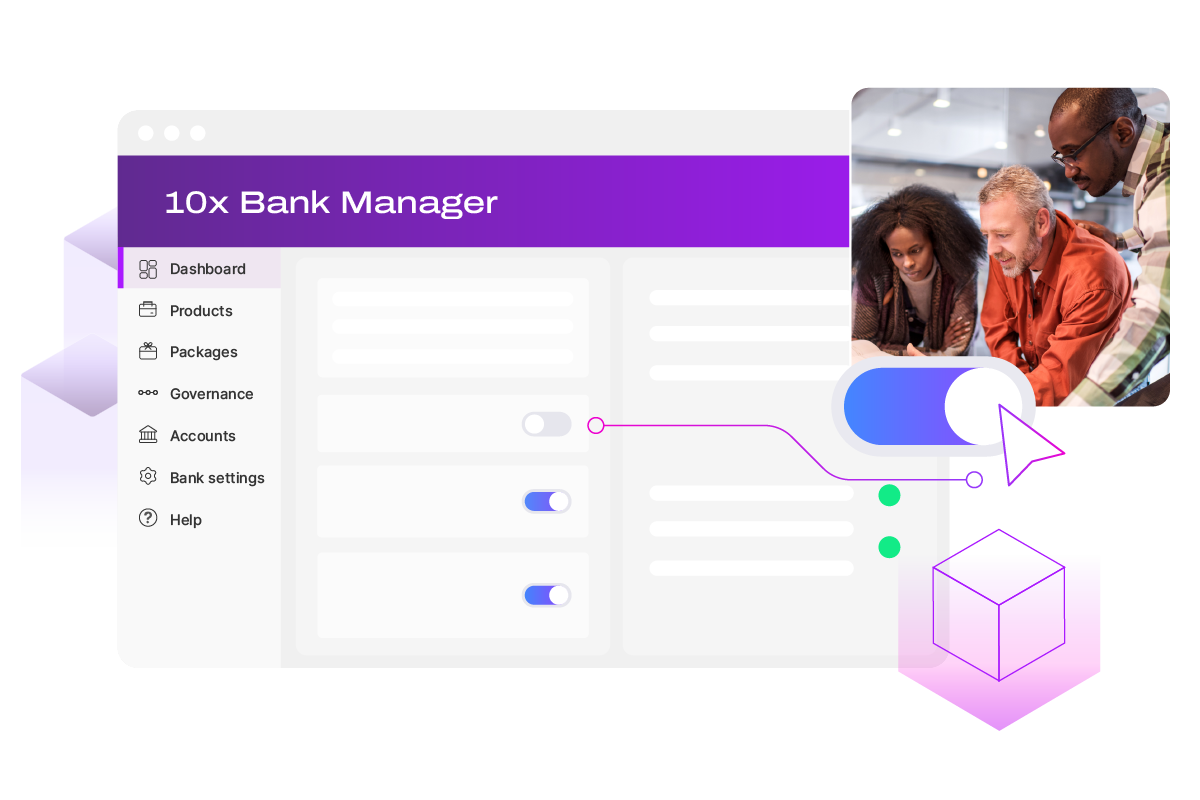

Create, update, and iterate in minutes

Click to build a competitive credit card that your customers love with Bank Manager, our no-code product builder.

Quickly add any banking feature – like cashback offers, rewards, and flexible installment plans – to build best-of-breed products.

Designing and evolving your proposition just got faster and easier.

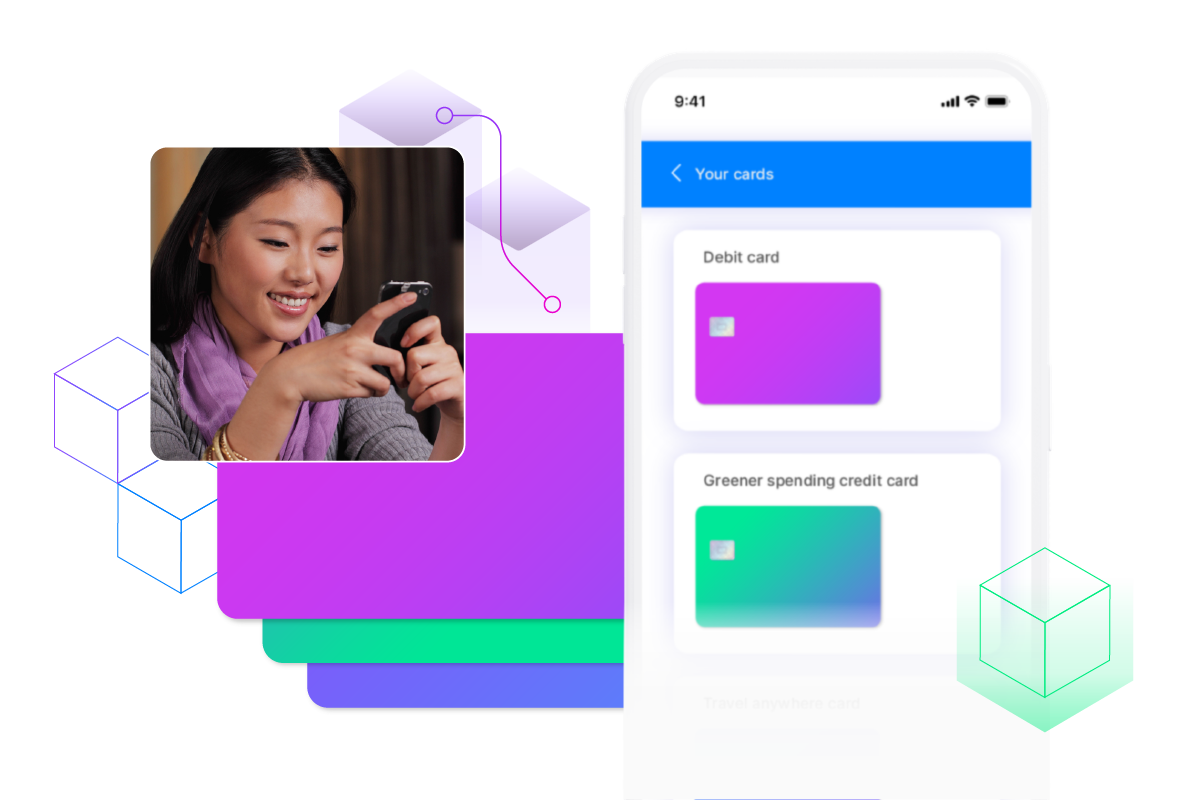

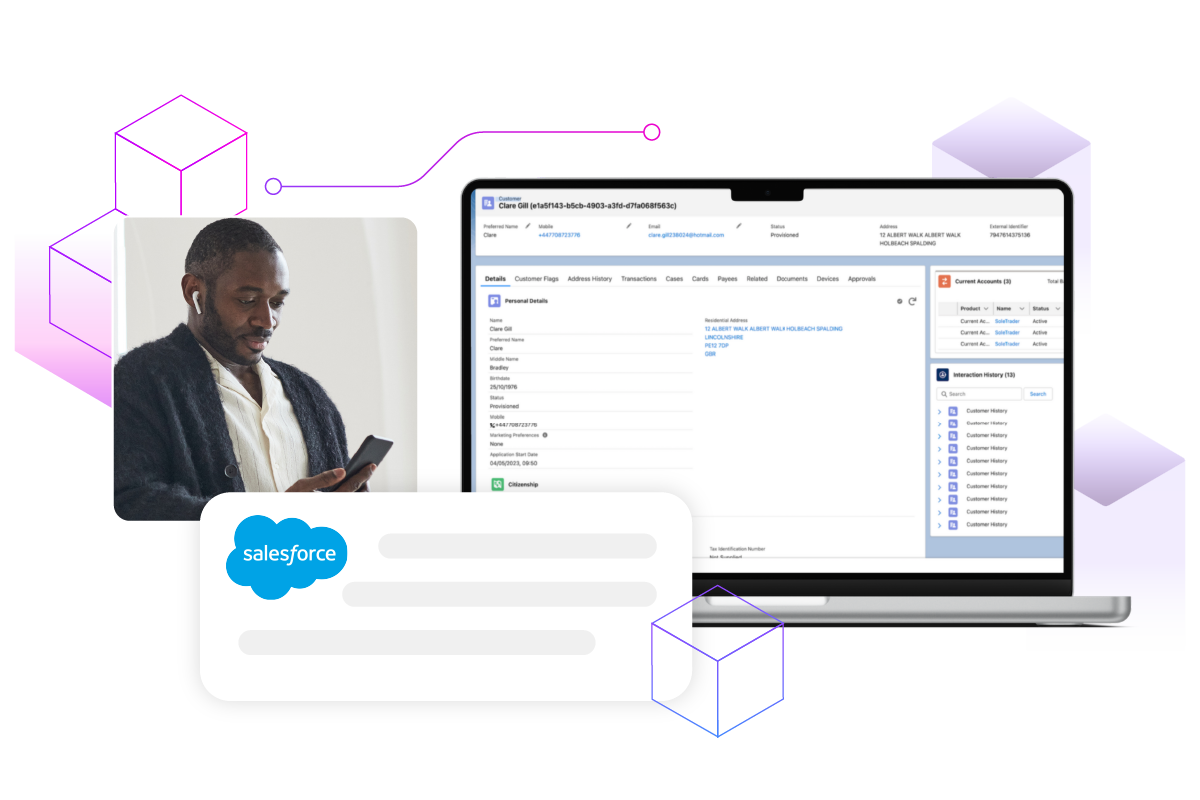

Create hyper-personalized experiences

With a 10x core, credit products become a fluid set of features that evolve over time based on customer usage.

Rich customer-facing functionality, such as embedded card controls, coupled with our API-first architecture, make building the best experience for your customers simple.

Our customer servicing module, powered by Salesforce, ties it all together, giving you a real-time 360° view of every customer to help resolve customer queries faster.

Key features

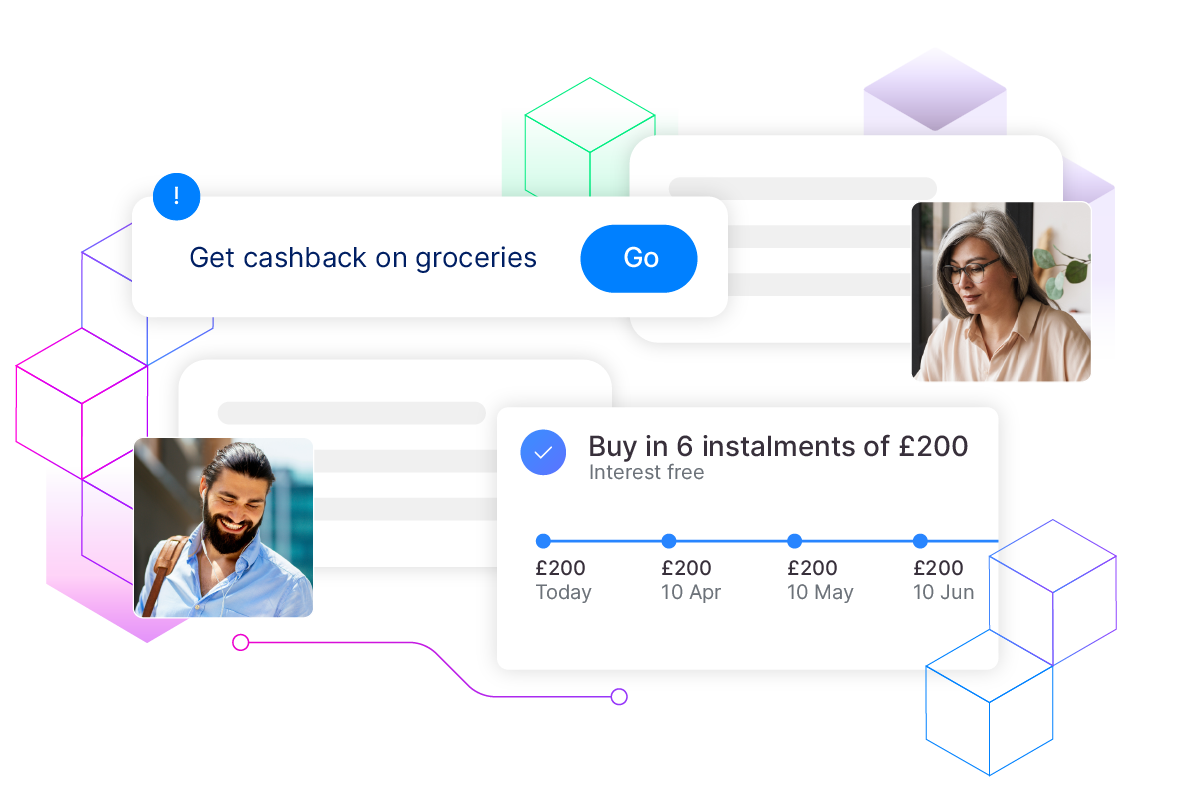

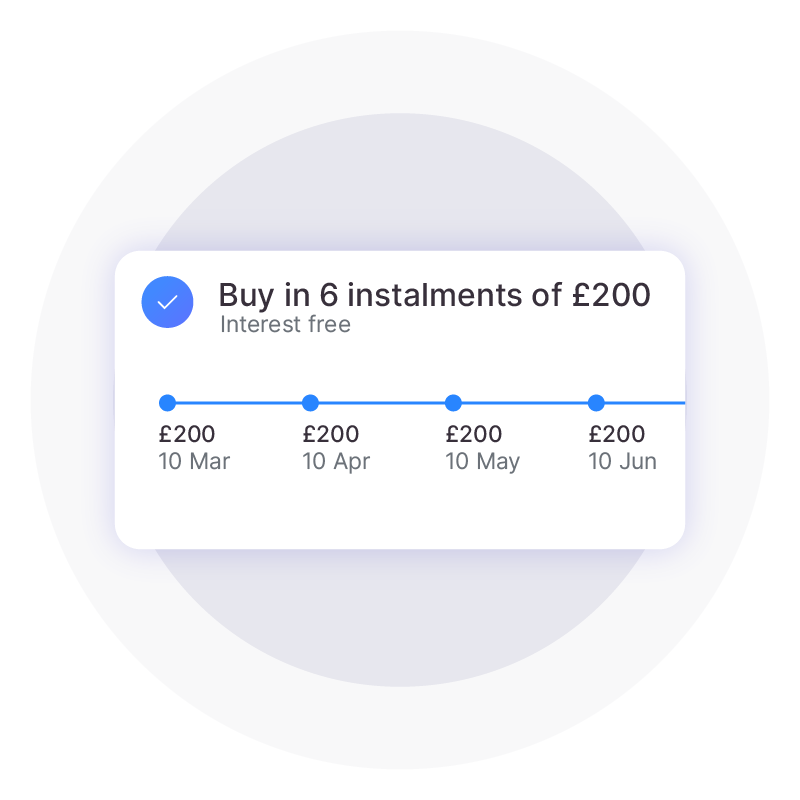

Turn credit purchases into installment plans

Compete with BNPL providers and let customers convert new and historic purchases into instalments, giving them more flexibility over their finances.

Card management and spending controls

Let customers setup limits on categories of their choice – like gambling, eating out, or shopping – and freeze/ unfreeze their cards.

Personalized rewards and pricing

Offer dynamic rewards, cashback offers, and tailored pricing. Let customers push new offers onto existing cards. Get everything you need to incentivize customers out of the box.