Corporate Banking

Give corporates the products, pricing, and insights to suit their individual needs.

As the role of treasury management evolves, your corporate clients need more than batch processing to understand their cash position. They need accurate, real-time data that takes the guesswork out of cash management; plus tailored products and pricing propositions to maximize their liquidity.

By rethinking your core banking platform, you can provide the latest liquidity management capabilities with zero integration costs and an innovative clicks-not-code approach to product development.

Your clients can standardize corporate accounting controls centrally while allowing for the right interest and fee optimization. This creates transparency for fast inter-company accounting that drives capital efficiency.

Relationship-led products and pricing

Launch innovative products in minutes. Finally, you can enable relationship pricing without the high manual overhead.

Release value fast

Liquidity management is built into the core from first principles, removing the need for complex and costly integrations.

Enable self-service

Open APIs enable virtual and physical account structures, sweeping, and pooling arrangements to be self-served and governed by the relationship pricing tariff.

Evergreen

A cloud-native SaaS solution that’s continually upgraded. Free up your IT budget from ongoing maintenance to continuous innovation.

Create value through cash management

Your clients need to optimize their working capital while enabling individual entities to operate independently. To make this happen, you need to unify your banking platform and redesign your operating model for the future of banking.

The 10x platform includes:

- An event streaming architecture and open APIs aligned to ISO20022. This gives your clients an accurate, 360-degree view of their accounts, providing real-time liquidity monitoring.

- Virtual accounts are built from first principles. This enables your clients to self-serve and create virtual accounts fit for their complex corporate structures enabling shared service models, POBO, and ROBO.

- Product and pricing changes are made in clicks not code. Create innovative products, update billing tariffs or tweak relationship pricing in minutes.

- Delivered as a SaaS platform, everything is ready to go from day one, fast-tracking your onboarding. No more lengthy implementation projects, expensive bolt-ons, or high operational overheads.

Everything you need to evolve your capability, delight your clients, and become a market-leading corporate bank.

Built for the needs of corporate cash management

Virtual accounts, multi-currency, sweeping and pooling

Virtual accounts, sweeping and pooling as standard, removing layers of complex system integration and cost

Self-serve virtual accounts, which can create capital efficiencies across even the most complex entity structures

Simplify accounts payables and automate the reconciliation of accounts receivables against the ledger as they are automatically processed and routed to the virtual account

Previously complex interest, fees, and billing approaches are radically simplified through virtual accounts, pooling, and compensated groups

Account grouping for multi-entity notional pooling and sweeping across accounts

Native multi-currency, supporting all ISO8601 currencies.

Scaled for the largest corporates

Real-time transaction processing with event streaming for built-in reconciliation and reporting

Open API integration for bank channels and ERP systems

Process millions of transactions in minutes, with zero downtime

Support automated funds control, financial adjustments, and account novations.

Relationship pricing

Provide client-level pricing at the account, relationship, or product level to drive client holdings and share of wallet

Create pricing tariffs based on client transactional behavior and balance holdings across grouped accounts

Automated charging and billing cycles aligned at the required entity level to support client structures.

Innovative solutions

Manage complex permissions, payment limits, and approval flows with our entitlements solution

Domestic and international payment orchestration, warehousing, routing, and repair

Relationship Manager and Associate servicing with secure chat and document exchange

Enable new distribution channels with Banking as a Service (BaaS) for your clients.

Lorem ipsum dolor sit amet, consectetur

Lorem ipsum dolor sit amet, consectetur

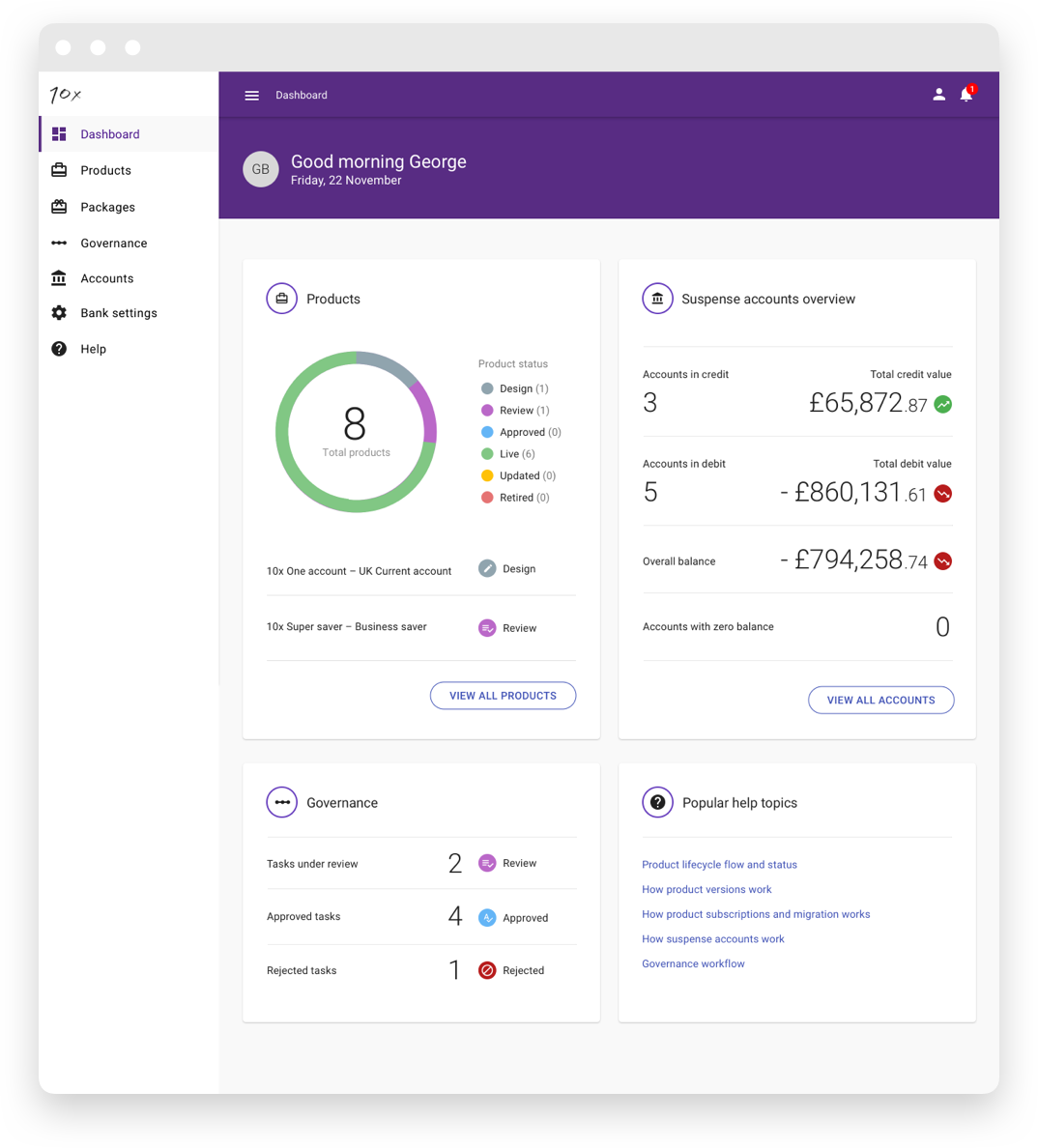

Introducing 10x SuperCore®

SuperCore is our cloud-native core banking platform. It’s used by the world’s leading banks to transform their operations, move into new markets, and unlock new revenue opportunities.

SuperCore is hands-down the fastest way to transform your bank. Chosen by Westpac, amongst others, to power their global transaction bank that's shaking up the corporate banking world.

Forget everything you know about corporate banking platforms: SuperCore transforms your client propositions for good.

Real-time data, faster decisions

Move from siloed data and batch reporting to a single data model and real-time insights. With rich data at their fingertips, your clients get strategic, actionable insight instantly.

With a microservices architecture, we think about products and capabilities differently. Our building blocks architecture means virtual accounts and liquidity management are built into our platform from first principles. This enables a no-code product, pricing, and liquidity solution that transforms your product and relationship pricing approach.

Build and update financial products and tariffs in minutes, not months, remove operational overhead and enable self-service. Now you can react quickly to market changes and client needs.

Imagine a world where 80% of your IT budget went on innovation, not maintenance. Welcome to our fully managed service for corporate core banking. So that you can focus your attention on what matters – your clients.

From pre-launch through to production, you have a team of 10x Consultants, Program Managers, and Engineers by your side, dedicated to your success.

SuperCore is an evergreen cloud-native environment where setup, maintenance, security, hosting, and ongoing compliance are taken care of.

Open APIs enable better collaboration between you, your clients, FinTechs, and other auxiliary services. Build a feature-rich banking ecosystem, leveraging our pre-integrated systems, to increase customer touch points and add value.

Go further and leverage your SuperCore to provide Banking-as-a-Service (BaaS) through your Corporate clients.