Build a greenfield bank

Start something new – build and scale the next big digital bank.

If you’re looking to launch an ambitious digital bank, you need a tech stack that you can trust. One that enables you to build innovative banking products, launch quickly, and serve millions of customers seamlessly.

SuperCore®, our cloud-native core banking platform, powers innovative digital banks like Chase UK.

Our fully managed service for core banking gives you a supportive partnership for building and scaling. So don’t waste time reinventing the wheel – partner with us for core banking to save time and budget.

The combined power of 10x and Salesforce enables joined-up, 360-degree customer servicing through one platform.

A cloud-native core that helps you move the market

How to build a bank in 12 weeks

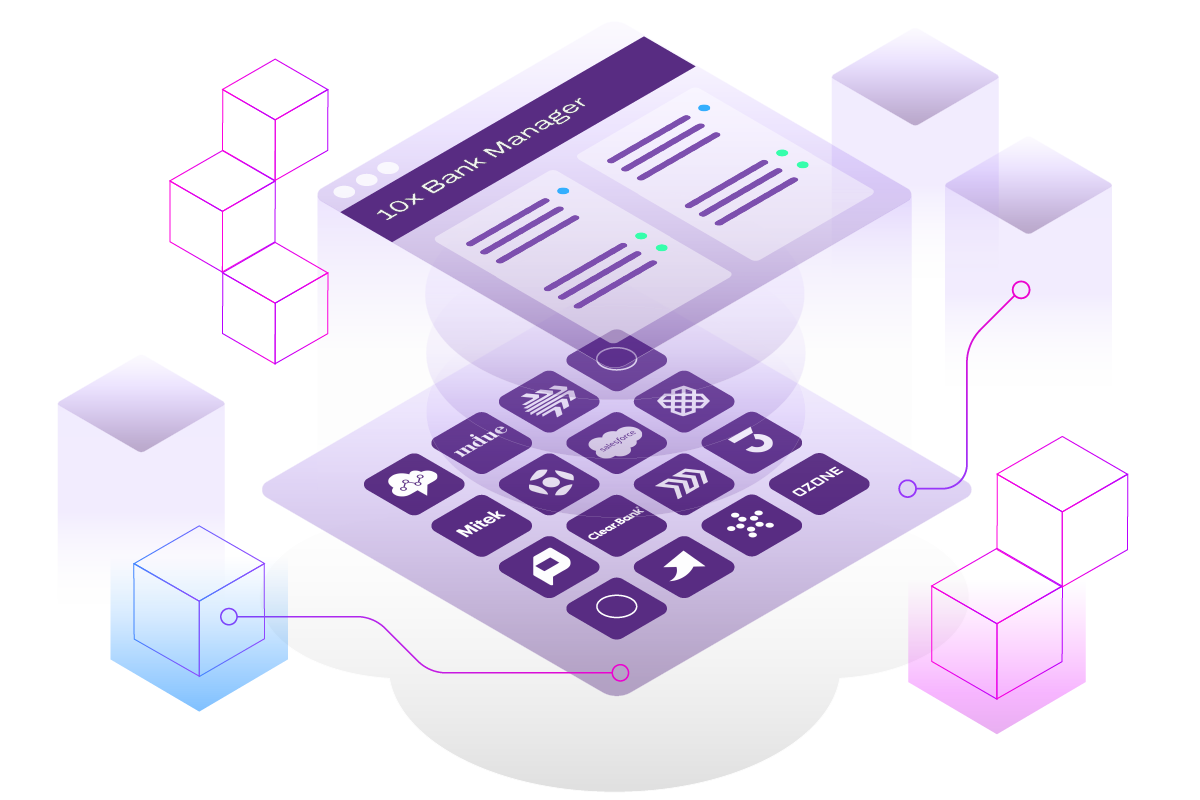

With our cloud-native core and an ecosystem of pre-integrated technologies, banks can reduce complexity and launch in as little as 12 weeks.

This video shows you how we make it possible.

Scale at the speed of your ambition

Build and launch a legacy-free digital bank

- Built for next-generation banks, SuperCore is built with speed to market in mind, making it much easier to launch the next big thing in banking.

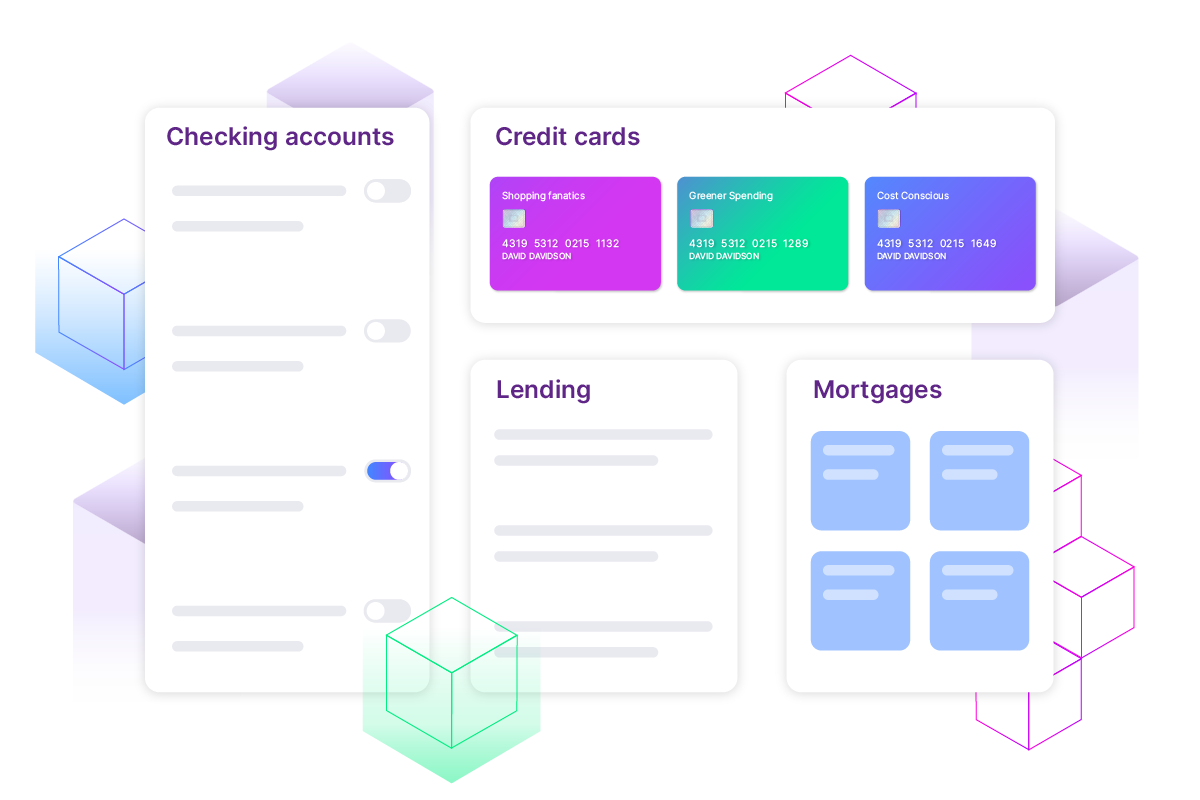

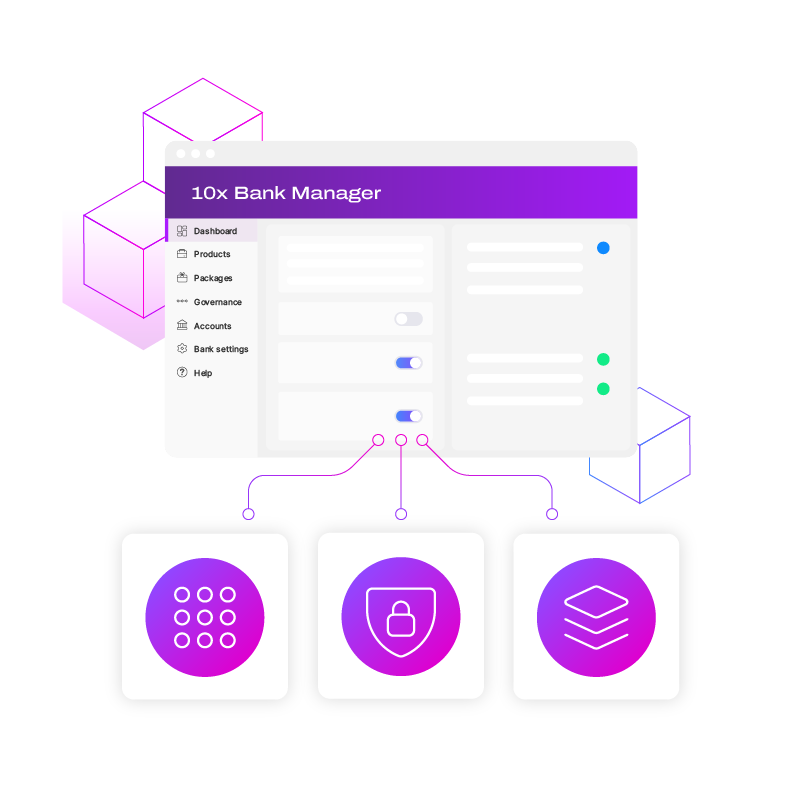

- Build feature-rich current accounts, credit cards, savings, and mortgage products in minutes with Bank Manager: our no-code product builder.

Use best-of-breed integrations to get off the ground quickly

- Accelerate your time to market with pre-integrated technologies across payments, card issuing/ processing, fraud, and customer servicing.

- Our API-first architecture makes integrating front and backend systems easier so you can build market-leading experiences that put your customers in control of their finances.

- Our customer servicing accelerator, powered by Salesforce, provides end-to-end contact center capability out of the box.

The core blocks of banking,

built to flex

- Our managed service ensures your core banking platform is always on, with 24x7 security operations, migration support, and much more.

- Our API-first architecture enables real-time connectivity to your preferred providers. Query complex transaction data quickly for front-end apps and personal finance management tools.

Create deeper customer relationships with real-time data

- Our real-time data model and Kafka events stream give you a deep understanding of every customer.

- Get a single view of every customer, across their entire banking relationship, for better customer service, marketing, and cross-selling opportunities.

- Automate with sweeps, savings targets, rewards, and budgets out of the box. Go the extra mile with our financial tools API.

Lead the market, in any market

12 minutes to create a product

Configure, test, and launch new products with just a few clicks.

12 weeks to launch a bank

Remove complexity from your tech stack to focus on value-add activities and swift deployment.

Millions of customers in less than 12 months

Powered by 10x SuperCore, Chase UK moved from launch to a million customers in months.

Your journey to live with 10x

Proof of Concept

Joint discovery

Dedicated client delivery team

Migration

A proven platform powering the world's biggest banks

Transformative

Predictable

Proactive

Agile

Trusted

Marketing and Communications

Lorem ipsum dolor sit amet, consectetur